Traditional IRAs let you invest for your retirement while reducing your tax burden. This means that you get the benefits of a traditional retirement account, but don’t have to pay taxes until you withdraw the money. When you withdraw from the account in retirement, you pay taxes at your future current tax rate.

What is a traditional IRA? Pros, cons, and how to get started

Table of Contents

Key Takeaways

-

Traditional IRAs are retirement accounts that let you invest funds and pay tax when you withdraw for retirement.

-

You can open a traditional IRA at a brokerage, bank, or robo-advisor. Depending on your plan, you can invest in the stock market, buy bonds, or purchase CDs.

-

Traditional IRAs have limits on how much you can contribute in a year, when you can take out your money without a penalty, and who qualifies for tax breaks.

What is a traditional IRA?

A Traditional IRA (Individual Retirement Account) is a type of investment account designed to help you save for retirement while deferring taxes. Contributions to a Traditional IRA are often tax-deductible, meaning they can reduce your taxable income for the year. The funds in the account grow tax-deferred, and you won’t owe taxes on your investments until you withdraw them during retirement.

Traditional IRAs differ from Roth IRAs in how they handle taxes. While Traditional IRAs use pre-tax dollars, Roth IRAs are funded with post-tax dollars, allowing for tax-free withdrawals in retirement. Traditional IRAs may be more suitable for individuals who expect their tax rate to stay the same or decrease in retirement, whereas Roth IRAs are often better for those who anticipate a higher tax rate later in life.

How does a traditional IRA work?

Money put into a traditional IRA is considered tax-deferred, meaning that you usually don’t pay taxes until you withdraw in retirement. At that point, you’ll pay federal income tax on your retirement income the same you would on ordinary income.

While IRAs can be a highly useful way to save for retirement, there are certain limitations on how much money can be invested, when withdrawals can occur, and who can claim the tax benefit:

- You can contribute a maximum of $7,000 per year in 2025 (or $8,000 if you’re over 50). Annual contribution limits for IRAs are in addition to anything you contribute to a 401(k) or other workplace savings account. If you have a spouse, you can each contribute to separate accounts up to the annual maximum.

- Withdrawing early usually carries a penalty. If you choose to withdraw from your account early (before you turn 59 ½), you’ll likely pay a 10% early withdrawal penalty on top of your standard income tax.

- At a certain age, you’ll be required to take distributions. You don’t have to start withdrawing as soon as you’re eligible, but you will have to start taking required minimum distributions (RMDs). The current age limit for RMDs is 72 for most younger investors.

- Tax advantages depend on your income and workplace retirement plans. Not everyone can make deductible contributions. If you have a workplace retirement plan, you may still need to pay taxes on your traditional IRA, depending on your income and filing status. The IRS sets the limits for income that qualifies for deductions according to your modified adjusted gross income (MAGI) on your tax return.

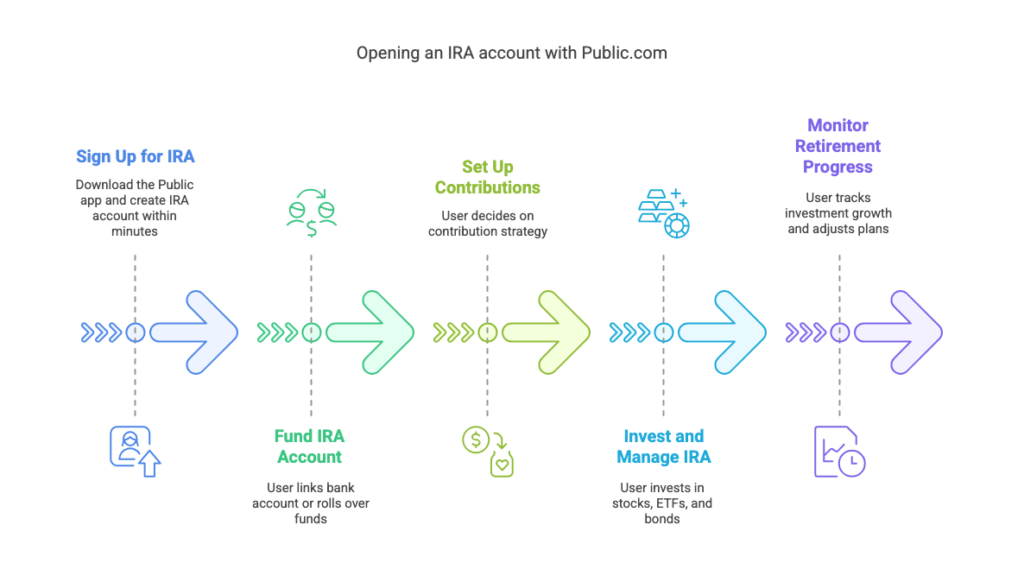

How to open an IRA account on Public.com

Public is an investor-friendly platform that simplifies the process of opening and managing IRA accounts. Whether you’re looking to build long-term retirement savings or roll over an existing IRA, Public.com offers a transparent and easy-to-use experience. Here’s how to get started:

1. Sign Up for an IRA account on Public

To open a Traditional IRA or a Roth IRA, download the Public app on iOS or Android. The platform provides a seamless onboarding process, guiding you through account setup and helping you understand your investment options.

2. Fund Your IRA Account

Once your IRA is set up, you can start contributing by:

- Linking a Bank Account: Transfer funds securely via ACH or debit card.

- Rolling Over an Existing IRA or 401(k): If you have a retirement account with another provider, Public.com supports rollovers, allowing you to consolidate and manage your investments in one place.

3. Set Up Contributions for Long-Term Growth

To stay on track with your retirement savings goals, you can choose:

- One-Time Deposits: Make individual contributions whenever it fits your financial plan.

- Automatic Contributions: Set up recurring deposits to ensure consistent contributions over time, helping to maximize potential tax benefits and long-term growth.

4. Invest and Manage Your IRA with Public.com

Public offers a user-friendly platform to help you build and manage a diversified retirement portfolio. You can invest in:

- Stocks, ETFs, and Bonds to align with your risk tolerance, investment horizon, and long-term retirement goals.

- Research and Analytical Tools that provide real-time market data, expert insights, and community discussions to support informed decision-making.

5. Monitor Your Retirement Progress

Public provides an intuitive dashboard where you can:

- Track investment growth and make adjustments as needed.

- Stay informed with real-time market data, analyst insights, and community discussions.

- Align your strategy with long-term retirement planning goals.

Manage your Traditional IRA and Roth IRA on Public while maximizing tax advantages and building a strong retirement foundation—all in one place. Invest in stocks, ETFs, crypto, bonds, options, a high-yield cash account, and U.S. Treasury bills with the flexibility to diversify your portfolio. Get started today!

Who is eligible to open a traditional IRA?

Anyone with earned income is eligible to open a traditional IRA. However, the tax deductibility of your Traditional IRA contributions depends on your income and whether you or your spouse has a retirement plan through work:

- If you or your spouse has a workplace retirement plan: The amount you can deduct is reduced—or even eliminated—once your income exceeds certain thresholds. You can still contribute to the IRA, but those contributions won’t be tax-deductible.

- If neither you nor your spouse has a workplace retirement plan: You can deduct the full amount of your Traditional IRA contributions, regardless of your income level.

Traditional IRA deduction limits in 2025

| Filing status | 2025 traditional IRA income limit | Deduction limit |

|---|---|---|

| Single (and covered by retirement plan at work) | $79,000 or less. | Full deduction. |

| Single (and covered by retirement plan at work) | More than $79,000, but less than $89,000. | Partial deduction. |

| Single (and covered by retirement plan at work) | $89,000 or more. | No deduction. |

| Married filing jointly (and covered by retirement plan at work) | $126,000 or less. | Full deduction. |

| Married filing jointly (and covered by retirement plan at work) | More than $126,000, but less than $146,000. | Partial deduction. |

| Married filing jointly (and covered by retirement plan at work) | $146,000 or more. | No deduction. |

| Married filing jointly (spouse covered by retirement plan at work) | $236,000 or less. | Full deduction. |

| Married filing jointly (spouse covered by retirement plan at work) | More than $236,000, but less than $246,000. | Partial deduction. |

| Married filing jointly (spouse covered by retirement plan at work) | $246,000 or more. | No deduction. |

| Married filing separately (you or spouse covered by retirement plan at work) | Less than $10,000. | Partial deduction. |

| Married filing separately (you or spouse covered by retirement plan at work) | $10,000 or more. | No deduction. |

Final Thoughts

A Traditional IRA offers tax-deferred growth and potential deductions, making it a valuable tool for retirement savings. Understanding contribution limits, withdrawal rules, and tax implications can help you make informed decisions.

With Public.com, opening and managing a Traditional IRA is simple. Invest in stocks, ETFs, and bonds while tracking your progress—all in one place. Get started today: Sign up for an IRA account on Public.com.

FAQs on Traditional IRAs

Do traditional IRA investments grow tax-free?

No, Investments in a Traditional IRA don’t grow entirely tax-free, but they do grow tax-deferred. This means you won’t pay taxes on your earnings—like interest, dividends, or capital gains—until you withdraw the money in retirement.

Is a traditional IRA the same as a 401K?

No, a traditional IRA is different from a 401(k). IRAs are individual retirement accounts that are not connected to your employer, and you can have one in addition to a 401(k).

Can you roll over a traditional IRA?

Yes, you can roll over a traditional IRA into a 401(k) if you’re looking to consolidate your retirement accounts. You can also roll over 401(k) accounts into a traditional IRA for more flexibility. Additionally, you can perform a Roth conversion to convert a traditional IRA into a Roth IRA.

Can I take an early withdrawal from my traditional IRA without a penalty?

Any early withdrawals from a traditional IRA will be subject to a 10% penalty. The only exception to this is if you roll over your traditional IRA into a 401(k) or convert it to a Roth IRA.