Trade options.

Earn rebates.

- Built-in rebates

- Industry-low fees

- Professional tools

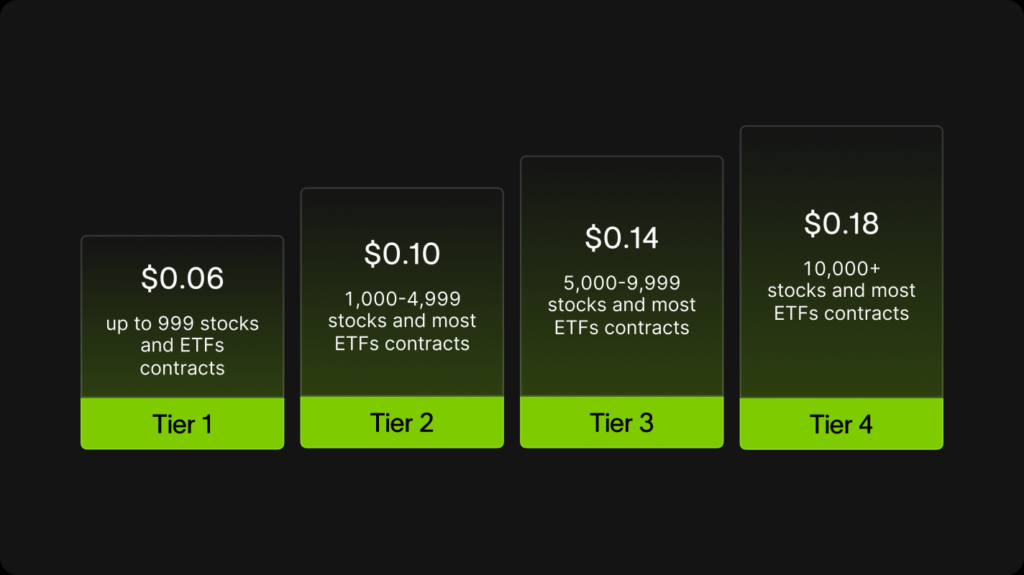

Options trading entails significant risk and is not appropriate for all investors. Customers must read and understand the Characteristics and Risks of Standardized Options before considering any options strategy. Options investors can rapidly lose the value of their investment in a short period of time and incur permanent loss by expiration date. Certain complex options strategies carry additional risk, including the potential for losses that may exceed the original investment amount, and are only available for qualified customers. Index options have special features and fees that should be carefully considered, including settlement, exercise, expiration, tax, and cost characteristics. See Fee Schedule for all options trading fees. Rebate rates vary monthly from $0.06-$0.18 and depend on the current and prior month’s options trading volume. Review Options Rebate Terms here. Rates are subject to change.

Maximize

your moves.

Minimize

your costs.

Earn a rebate on every stock and ETF contract

*We provide an adjusted rebate on QQQ, SPY, and IWM contracts.

Members in Tiers 1-3 earn $0.06 per contract, while Tier 4 earns $0.10 per contract.

On Public, you can earn $0.06–$0.18 for stock or ETF options contracts you trade, with higher earnings as you trade more contracts each month.

See Fee Schedule for all options trading fees. Rebate rates vary monthly from $0.06-$0.18 and depend on the current and prior month’s options trading volume. Review Options Rebate Terms here. Rates are subject to change.

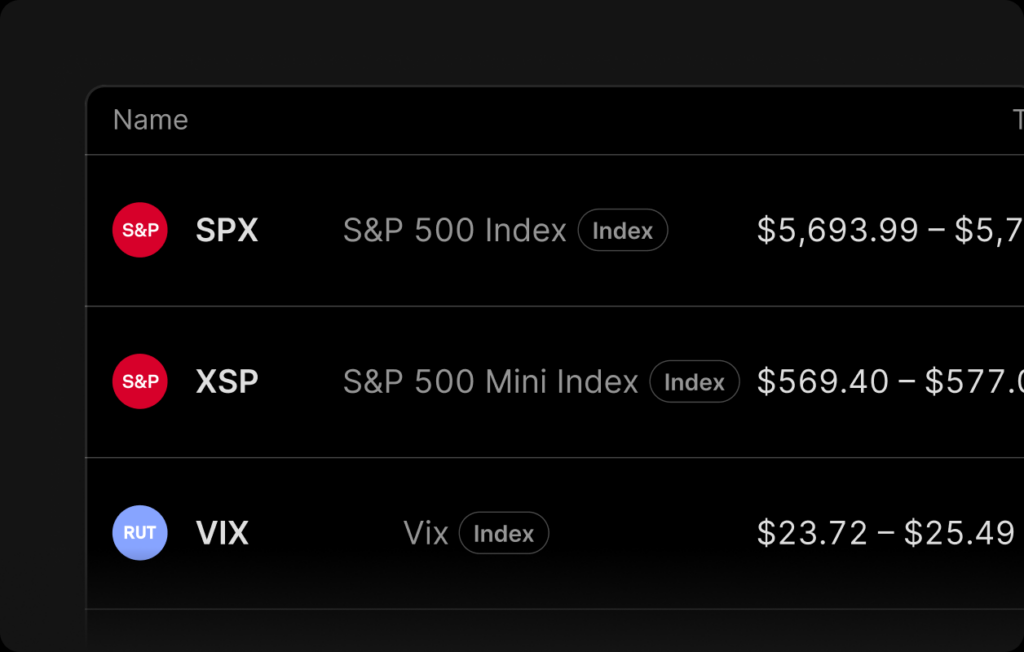

From SPX to VIX. With industry-low fees.

At just $0.35–$0.50 per contract, you can expand your options trading strategies with some of the largest indices, including NDX, SPX, VIX, and CBTX.

Index options have special features and fees that should be carefully considered, including settlement, exercise, expiration, tax, and cost characteristics. See Fee Schedule for all options trading fees.

Access margin rates as low as 5.50%*

Level 3+ options traders enrolled in margin investing can access some of the industry's lowest margin rates and unlock advanced options strategies.

Public Investing charges a variable margin interest rate based on your margin balance and the upper limit of the Federal Funds Target Range, which is set by the Federal Reserve and is subject to change without notice. The formulas used to calculate the margin interest rate are subject to change at Public Investing’s discretion. The margin interest rates shown are as of 3/1/25. For more information, please see Public Investing’s Fee Schedule and Margin Disclosures.

Five features built for options traders

Trade Bitcoin ETP options. No wallet required.

By trading options on Bitcoin ETPs—including IBIT, GBTC, and FBTC—you can gain exposure to Bitcoin’s price action without directly owning crypto.

Investing involves risk, including risk of loss of principal. Investors should consider the fund’s investment objectives, risks, charges, and expenses and unique risk profile. Please read the IBIT, GBTC, FBTC prospectus carefully before investing.

A spot bitcoin exchange-traded product (“ETP”) is not an investment company registered under the Investment Company Act of 1940 (the “1940 Act”) and is not subject to regulation under the Commodity Exchange Act of 1936 (the “CEA”). As a result, shareholders do not have the protections associated with ownership of shares in an investment company registered under the 1940 Act or the protections afforded by the CEA. The performance of a spot bitcoin ETP will not reflect the specific return an investor would realize if the investor actually purchased bitcoin. Investors will not have any rights that bitcoin holders have and will not have the right to receive any redemption proceeds in bitcoin. Digital assets like Bitcoin are highly speculative and may be subject to increased risk of price volatility, illiquidity, market manipulation, and loss, including loss of your entire investment.

Master options trading at your own pace

From basic concepts to advanced strategies, our comprehensive library of guides and videos covers everything you need to know about options trading.

Learn moreHave questions? Find answers.

How much does it cost to trade options on Public?

Unlike other options trading platforms, we don’t charge commission fees or per-contract fees. What’s more, at Public, we share 50% of our options trading revenue directly with you, the customer. That means you can earn a rebate every time you place an options trade—making Public the cheapest way to trade options.

What options strategies are available on Public?

We’re launching options trading on Public with fundamental strategies, including long calls, long puts, and covered calls. However, stay tuned for more options trading strategies coming soon, including covered strategies and multi-leg strategies. We plan to launch straddles, strangles, call debit spreads, call credit spreads, put debit spreads, put credit spreads, long call calendar spreads, and long put calendar spreads.

What is options revenue sharing and how does it work?

At Public, we’ve always worked to try to get you the best deal for your trades—and options trading is no different. That’s why, in an industry first, we’re sharing 50% of our payment for order flow revenue directly with you, the customer.

In the options world, every order gets executed on exchange, and payment for order flow is an essential part of the market structure. But now, you can share in the revenue it generates. Every time you place an options trade on Public, you’ll receive 50% of our payment for order flow revenue, minimizing your transaction costs.

Why are options considered riskier than other investments?

Options are considered riskier than many other investments because they are leveraged instruments, meaning that a small investment can lead to large gains or losses. Option prices can fluctuate significantly, and the potential for the total loss of your investment is higher than stocks or bonds.

Have additional questions about Options on Public?

Our US-based customer experience team has FINRA-licensed specialists standing by to help.

Simple. Sophisticated.

Significantly cheaper.

Sign Up