When you’re planning an investment strategy, you may hear a lot about treasury bonds. These government-issued securities have long been a reliable option for those seeking low-risk investments. But what exactly are treasury bonds, how do they work, and how can you invest in treasury bonds?

Let’s break it all down for you.

What are treasury bonds?

Table of contents

Key takeaway

-

Treasury bonds (T-bonds) are long-term securities issued by the U.S. government, mature in 20-30 years ,and pay interest every six months.

-

They are considered one of the safest investments, backed by the full faith and credit of the U.S. government.

-

Interest earned is exempt from state and local taxes but is subject to federal tax.

-

You can buy Treasury bonds directly through TreasuryDirect or through a brokerage account.

What is a treasury bond (T-bond)?

Treasury bonds, often referred to as “T-bonds,” are long-term debt securities issued by the U.S. Department of the Treasury. When you invest in a T-bond, you’re essentially lending money to the federal government in exchange for periodic interest payments and the return of your principal when the bond matures.

Here’s what defines treasury bonds:

- Issuer: U.S. Department of the Treasury

- Maturity period: 20 to 30 years

- Interest payments: Semi-annual

- Risk level: Low (backed by the U.S. government)

- Taxation: Exempt from state and local taxes, but subject to federal income tax

How do treasury bonds work?

When you purchase a Treasury bond, you are lending money to the U.S. government for a fixed period, usually 20 or 30 years. The government uses your investment to fund public projects and cover national expenses.

In return, you receive interest payments every six months, known as coupon payments. These payments are based on the bond’s coupon rate, which is set at the time of issuance. Treasury bonds are considered one of the safest investments, with a highly liquid secondary market.

Issuance & purchase:

- The U.S. Treasury issues T-bonds through auctions conducted by the TreasuryDirect platform.

- You can buy them directly from the U.S. government or through banks, brokers, and financial institutions.

Maturity & terms:

- T-bonds have long maturities, typically 20 to 30 years.

- You receive interest payments (coupon payments) every six months until maturity.

- At maturity, the government repays the face (par) value of the bond.

Interest rates & yields:

- The interest rate (coupon rate) is fixed when the bond is issued.

- The yield (effective return) depends on the bond’s purchase price in the secondary market.

Buying & selling:

- You can hold T-bonds until maturity or sell them in the secondary market.

- Bond prices fluctuate based on interest rates. If interest rates rise, bond prices fall, and vice versa.

Tax benefits:

- Interest earned on T-bonds is exempt from state and local taxes but subject to federal taxes.

Let’s take a look at how treasury bonds work with an example:

Let’s say you invest $10,000 in a 30-year U.S. Treasury bond with a 4% annual coupon rate. Here’s how it works:

1. Purchasing the bond:

- You buy a $10,000 T-bond at face value (par) with a 4% annual interest rate.

- The bond matures in 30 years.

2. Earning interest (Coupon payments):

- Treasury bonds pay interest twice a year (semiannually).

- Your annual interest = 4% of $10,000 = $400.

- Since payments are semiannual, you receive $200 every six months.

3. Total interest over 30 years:

- You receive $200 x 2 times per year = $400 per year.

- Over 30 years, you earn $400 x 30 = $12,000 in total interest.

4. Maturity (Getting your principal back):

- At the end of 30 years, the U.S. government returns your $10,000 principal.

Final return on investment:

- Total interest earned: $12,000

- Principal repaid: $10,000

- Total money received over 30 years: $22,000

Where can investors buy Treasury bonds?

You can buy U.S. Treasury Bonds (T-bonds) directly from the U.S. government or through financial institutions like banks and brokers. The primary methods include:

1. Buying directly from the U.S. government (TreasuryDirect)

You can purchase T-bonds through TreasuryDirect.gov, the official platform run by the U.S. Department of the Treasury.

You need to create an account, link your bank account, and participate in auctions where bonds are sold at face value or a discount.

Once purchased, the bond is held in your TreasuryDirect account, and you receive interest payments directly to your linked bank account.

2. Buying through ETFs and mutual funds

Via ETFs or Mutual funds: You can invest in Treasury bonds indirectly through exchange-traded funds (ETFs) and mutual funds. These funds often hold a diversified portfolio of U.S. Treasury securities, including bonds, notes, and bills.

Investing through ETFs or mutual funds can provide more liquidity and diversification than holding individual Treasury bonds.

3. Buying through a brokerage firm

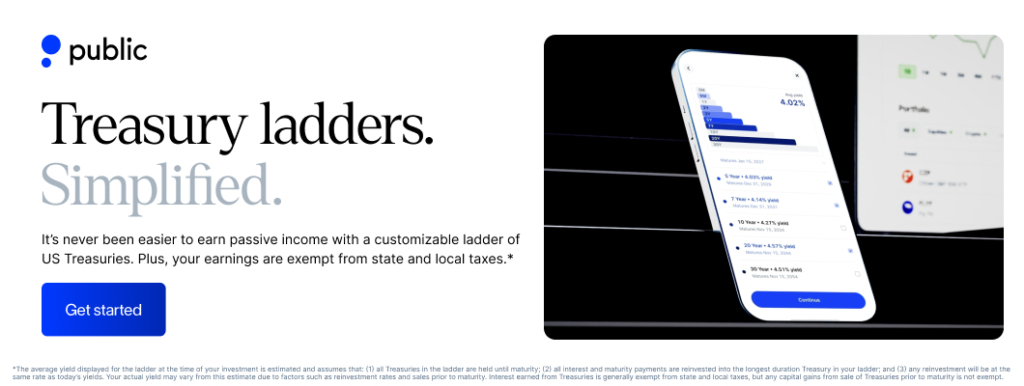

You can buy treasury bonds through brokerage platforms like Public.com, where it may offer more flexibility, such as the ability to trade your bonds on the secondary market if you need liquidity before maturity.

Public.com makes it simpler for investors to explore bonds alongside other investment options such as stocks, ETFs, crypto, and more—all in one place.

How to Invest in US Treasuries on Public.com

Public makes it easy to invest in U.S. Treasuries and build a custom Treasury ladder—all from one platform. Follow these simple steps to get started:

1. Sign Up for a Treasury Account

Download the Public app on iOS or Android, or sign up on the web. The onboarding process is quick and guides you through setting up your Treasury account.

2. Fund Your Account

Easily add funds using Bank Transfer (ACH), Debit Card, or Wire Transfer

3. Choose Your US Treasury Investment

Select from Treasury bills, notes, or bonds with maturities ranging from 3 months to 30 years. Lock in your yield at purchase and enjoy state and local tax exemptions.

4. Complete Your Purchase

Review your selection, confirm your investment amount, and finalize your purchase. Your Treasury investment will be added to your portfolio.

5. Manage Your Portfolio in One Place

Track and manage your US Treasuries, stocks, ETFs, crypto, bonds, options, IRAs, and high-yield cash—all within Public’s platform.

Some advantanges of investing in US treasury bonds

Investing in U.S. Treasury Bonds (T-bonds) offers several benefits, making them an attractive option. Here’s why:

1. Safety & reliability

U.S. Treasury Bonds are one of the safest investments because they are backed by the full faith and credit of the U.S. government, ensuring zero default risk.

This makes them a reliable option for people looking to protect their capital while earning steady returns over time.

2. Stable & predictable returns

Their fixed-interest payments provide a predictable income stream, making them ideal for those who want financial stability.

With semiannual coupon payments, you can count on a consistent flow of passive income, which is especially beneficial for retirees and long-term planners.

3. Portfolio diversification

Treasury bonds also help in portfolio diversification by balancing out riskier assets like stocks.

Since they tend to perform well during economic downturns, they act as a hedge against market volatility, providing a cushion against potential losses in a well-diversified portfolio.

4. Tax benefits

The tax advantage of T-bonds makes them even more attractive, as the interest earned is exempt from state and local taxes.

This means you get to keep more of their returns compared to other taxable fixed-income investments, improving their overall financial efficiency.

5. Liquidity & flexibility

Despite their long-term maturity, T-bonds offer flexibility as they can be sold in the secondary market before maturity.

This ensures that you have access to liquidity if they need to cash out their investment early, making them more versatile than they might initially appear.

6. Hedge against recession & market volatility

T-bonds become a go-to investment during economic recessions and financial crises because of their stability.

Bond prices tend to rise as you move towards safer assets, further enhancing their appeal as a secure store of value in uncertain times.

7. Suitable for retirement & long-term goals

For those planning retirement or long-term financial goals, T-bonds offer a reliable way to preserve capital while earning passive income.

Their long maturity periods make them well-suited for building wealth steadily over decades, ensuring financial security for the future.

Conclusion

Investing in Treasury bonds may not bring the thrill of high-risk investments, but they offer something just as valuable—peace of mind. If safety and steady income are high on your priority list, Treasury bonds can be a smart way to add stability to your portfolio.

Backed by the U.S. government, they provide a predictable income stream that can support your long-term financial goals, whether you’re planning for retirement or simply looking to balance riskier assets.

If you’re considering investing in treasury bonds, Public’s Treasury Account offers a seamless way to buy T-bonds with maturities ranging from 20 to 30 years.

With the ability to lock in your yield at purchase, benefit from state and local tax exemptions, and access an easy-to-use platform, Public simplifies the process while providing added liquidity and support.

By choosing the right investment method, you can optimize your Treasury investments based on your risk tolerance, liquidity needs, and long-term strategy.

Frequently asked questions

What is the minimum investment for Treasury bonds on Public.com?

You can start investing in the Treasury bonds on Public with as little as $1000, and there is no maximum investment limit.

How often do Treasury bonds pay interest?

Treasury bonds pay interest semi-annually, meaning you receive interest payments every six months until maturity. These semi-annual payments are based on the bond’s fixed coupon rate.

Can I sell my Treasury bond before it matures?

Yes, you can sell your Treasury bond before it matures through the secondary market. If you hold your Treasury bonds through a Public Treasury Account, you can manage and sell your bonds directly within your brokerage account.

How safe are T-bonds as an investment?

T-bonds are one of the safest investments because they are backed by the full faith and credit of the U.S. government, which has never defaulted on its debt. However, while they protect your principal if held to maturity, their market value can fluctuate if sold early due to interest rate changes.

What are the tax implications of T-bonds?

The interest earned from T-bonds is subject to federal income tax but exempt from state and local taxes, making them more tax-efficient than many other fixed-income investments.

However, if you sell a T-bond before maturity at a profit, you may owe capital gains tax on the earnings. Taxes on interest income may be paid annually or deferred until the bond matures.

What are the risks associated with Treasury bonds?

While T-bonds are generally safe from default, they still carry risks. Interest rate risk is a major concern—when interest rates rise, bond prices fall, which may lead to losses if sold before maturity.

Inflation risk can erode purchasing power over time, as T-bond interest rates may not always keep up with rising costs. Additionally, liquidity risk exists in the secondary market, where selling before maturity might result in lower returns.