When it comes to retirement planning, IRAs (Individual Retirement Accounts) play a significant role in helping Americans secure their financial future. Two of the most popular types are the Roth IRA and the Traditional IRA. While both provide tax advantages and the opportunity to grow your retirement savings, they differ in how contributions, withdrawals, and taxes are structured. Choosing the right IRA depends on your current income, tax bracket, and retirement goals.

In this comprehensive guide, we’ll compare the features of Roth IRAs and Traditional IRAs, dive into annual limits, income thresholds, and tax implications, and help you decide which might be better suited to your financial situation.

What Are Roth IRAs and Traditional IRAs?

Before diving into comparisons, it’s important to understand what Roth IRAs and Traditional IRAs are and their primary benefits. At their core, both accounts are tax-advantaged tools designed to encourage retirement savings, but the timing of tax benefits is what sets them apart.

- Traditional IRA: You contribute pre-tax dollars (potentially getting a tax deduction), grow your money tax-deferred, and pay income taxes when you withdraw funds in retirement.

- Roth IRA: You contribute after-tax dollars (no immediate tax break), grow your money tax-free, and take qualified withdrawals tax-free in retirement.

Contribution Limits for 2025 (Roth IRA and Traditional IRA)

The IRS sets annual contribution limits for IRAs, which apply to Roth and Traditional accounts alike. For 2025, here’s what you need to know:

- Contribution Limit: $7,000 per year if you’re under 50.

- Catch-Up Contributions: If you’re 50 or older, you can contribute an additional $1,000, bringing the annual limit to $8,000.

- The contribution limit applies across all your IRAs. If you have both a Roth and a Traditional IRA, the total combined contributions cannot exceed $7,000 (or $8,000 for those 50+).

Income Limits for Roth IRA Contributions (2025)

Roth IRAs have income restrictions, meaning not everyone qualifies to contribute directly. Your ability to contribute starts phasing out at certain income levels based on your tax filing status:

Single Filers or Head of Household:

- Full Roth IRA Contribution: Modified Adjusted Gross Income (MAGI) under $146,000.

- Partial Contribution: MAGI between $146,000 and $161,000.

- Ineligible: MAGI above $161,000.

Married Filing Jointly:

- Full Contribution: MAGI under $228,000.

- Partial Contribution: MAGI between $228,000 and $243,000.

- Ineligible: MAGI above $243,000.

If your income exceeds these limits, you may still contribute to a Roth IRA through a Backdoor Roth IRA strategy.

IRA Tax Advantages: Timing is Everything

One of the key differentiators between Roth and Traditional IRAs is when the tax advantage applies:

Traditional IRA: You may qualify for a tax deduction on your contributions (depending on your income and access to a workplace retirement plan). Taxes are deferred until you take withdrawals, at which point they are taxed as ordinary income. This can be beneficial if you expect to be in a lower tax bracket during retirement.

Roth IRA: Contributions are made with after-tax dollars, but funds grow tax-free, and qualified withdrawals in retirement are 100% tax-free. This works well if you expect to be in a higher tax bracket when you retire.

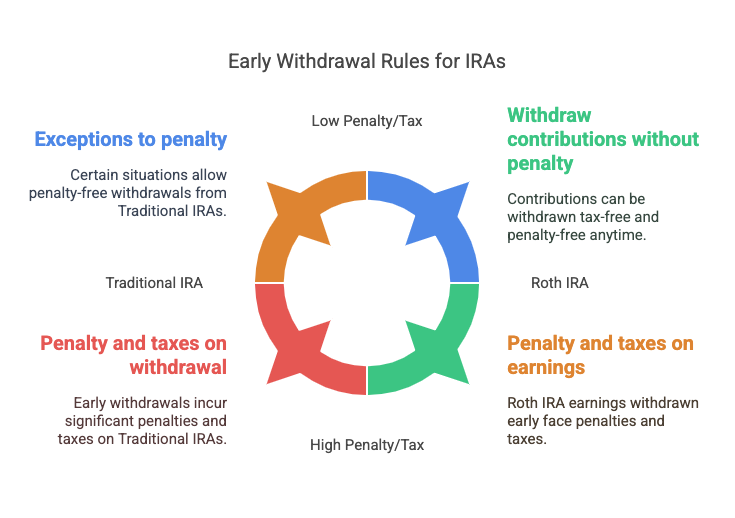

Early Withdrawal Rules: Accessing Your Money Before Retirement

Both accounts impose penalties and taxes for early withdrawals, but Roth IRAs are generally more flexible:

Traditional IRA: Withdrawals before age 59½ are subject to a 10% penalty plus ordinary income taxes on the amount withdrawn. Exceptions apply for cases like first-time home purchases or certain medical expenses.

Roth IRA: Contributions (but not earnings) can be withdrawn at any time without taxes or penalties. Earnings withdrawn before age 59½ may be subject to taxes and a penalty unless you meet specific criteria (e.g., using funds for qualified education expenses or a first-time home purchase).

How to decide between Roth IRA or Traditional IRA?

Choosing between a Roth and Traditional IRA depends on several factors, including your income, age, and financial goals. Here are some steps to guide your decision:

1. Assess Your Current and Future Tax Bracket

If you think your tax rate will be lower in retirement, a Traditional IRA may help you save on taxes now.If you anticipate your tax rate will be higher in retirement, a Roth IRA can help you lock in today’s lower rate and enjoy tax-free withdrawals later.

2. Consider Your Income Level

If your income disqualifies you from contributing to a Roth IRA, a Traditional IRA might be the better option. Alternatively, explore the backdoor Roth IRA strategy if you earn above the Roth IRA income thresholds.

3. Prioritize Flexibility

With no RMDs and penalty-free withdrawal of contributions, the Roth IRA provides more flexibility, making it a popular choice for long-term planners.

Final Thoughts

When deciding between a Roth IRA vs a Traditional IRA, the best choice is a personal one, based on your current finances, tax situation, and long-term goals. Regardless of which path you choose, maximizing your contributions and starting early can significantly impact your retirement savings.

Ready to open or contribute to your IRA? Start building your retirement savings by Opening an IRA on Public.com today