The 1999 1st Edition Holographic Charizard card is recognized as the holy grail of the entire Pokmon trading card game, and seen as one of the most iconic non-sports cards.

The first edition set was released in limited quantity with 102 cards total, 16 of them being the rarer, coveted holographic cards. The holographic Charizard card became the most popular for a variety of cultural reasons at the time.

We wanted to break down how we thought about the card as an investment.

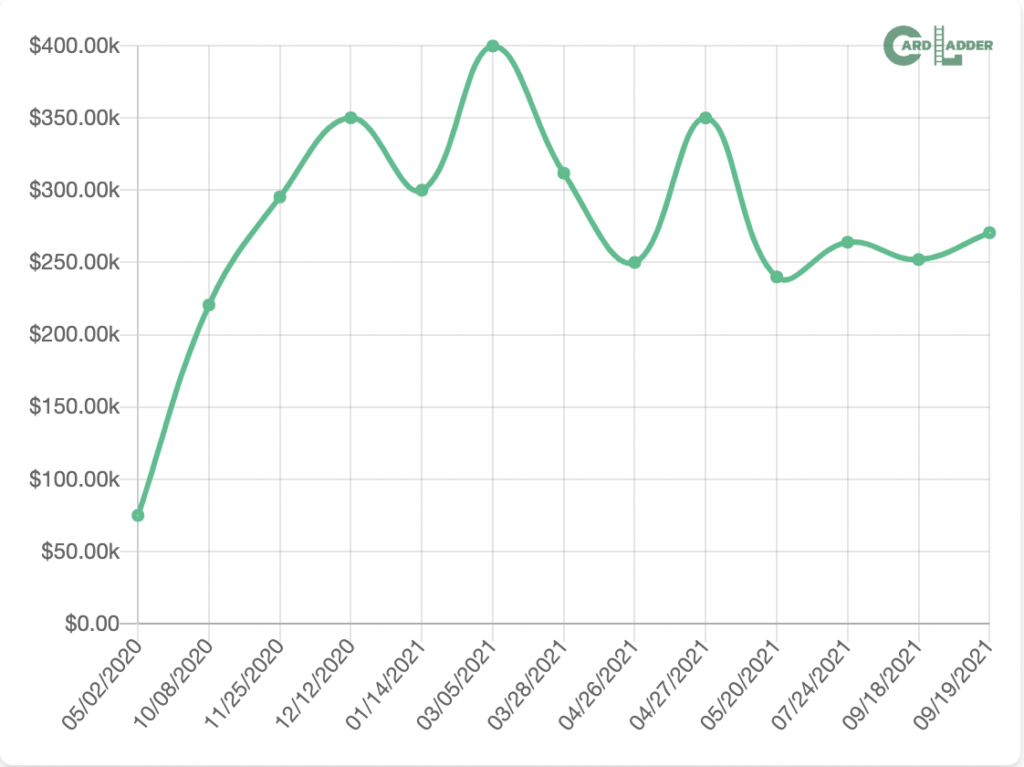

Sales History

A quick glance at Card Ladder data clearly illustrates the trajectory of the Charizard card over time and the recent boom.

As one can see, the card peaked in March 2021 at $399,7500, sold by Goldin Auctions, then saw declines. However, the two most recent auction sales at prices of $264,000 and $270,600 (Heritage, Goldin) may suggest the start of some price stabilization and continued strong demand.

Market Trajectory

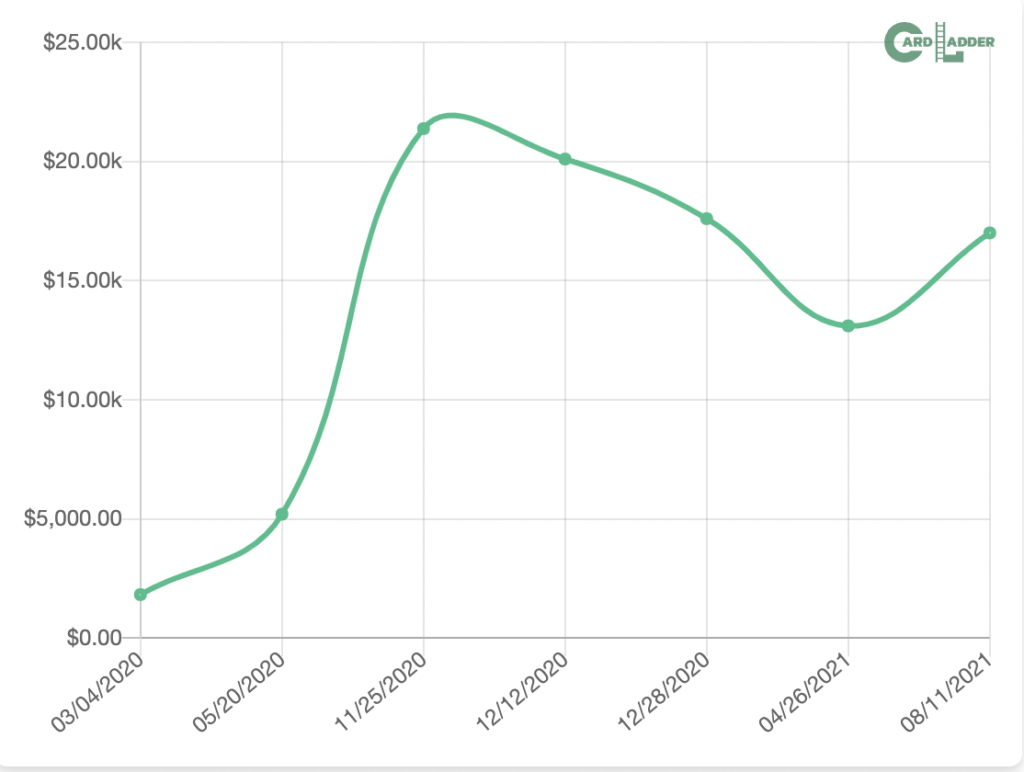

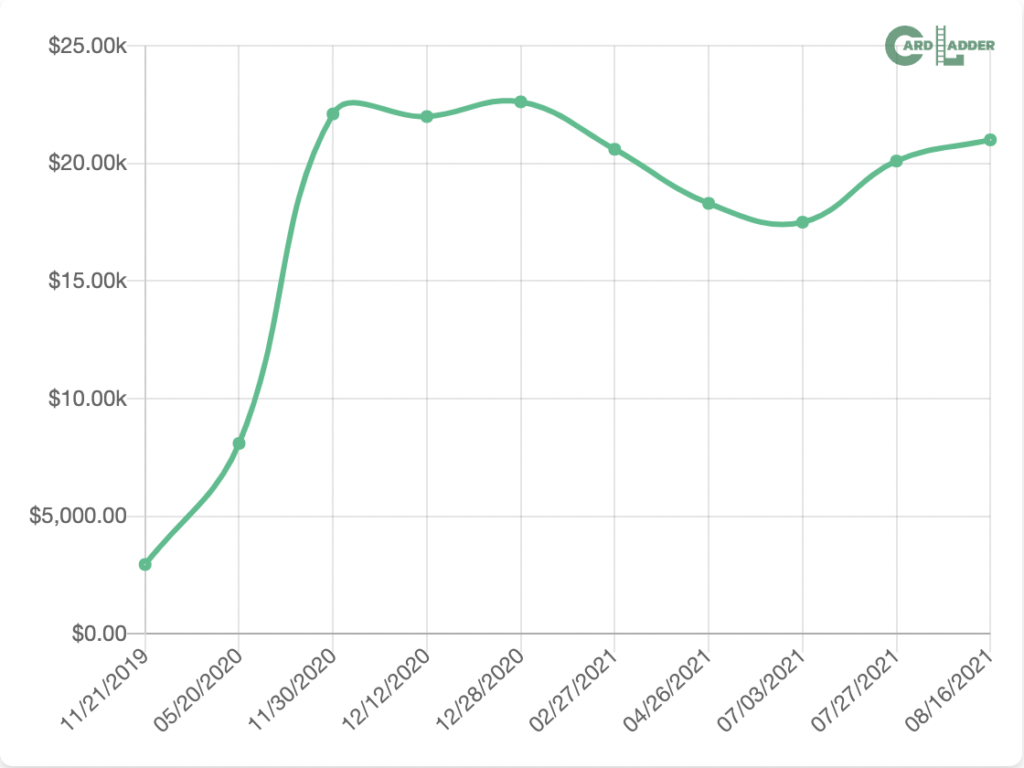

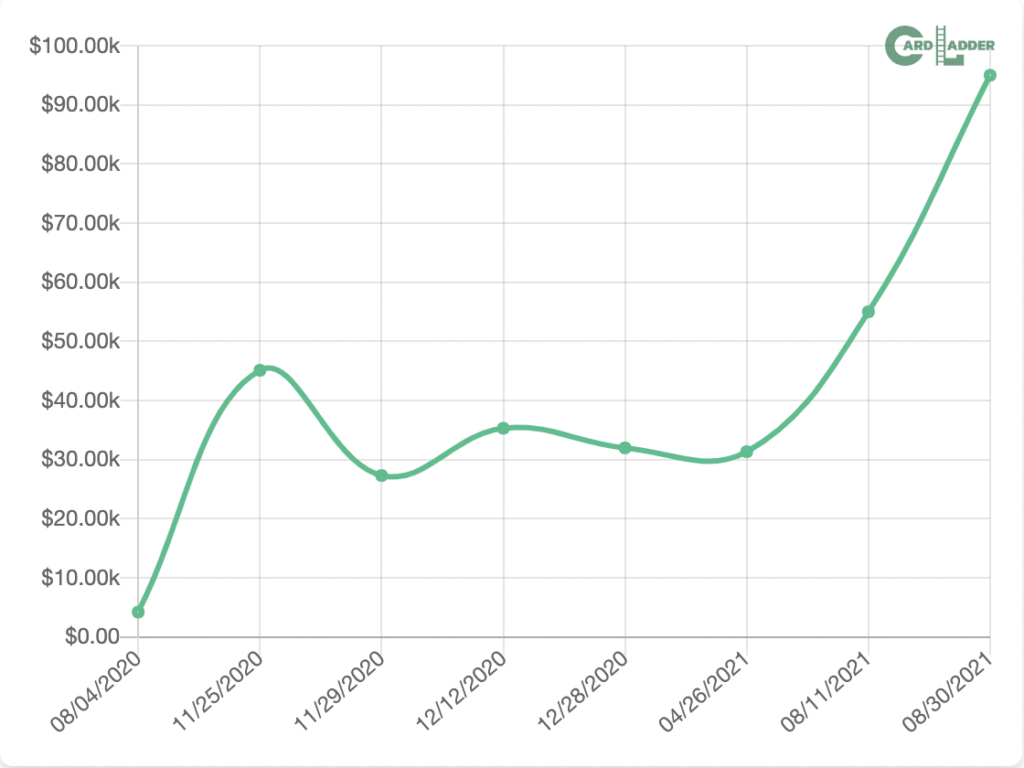

We observe similar trends to Charizard when looking at other high-end Pokmon cards from the 1999 1st edition set, such as Mewtwo, Venusaur, and Blastoise. Prices for these cards experienced a similar boom in 2020, a subsequent correction, and then a leveling off after the dip (with the exception of Blastoise, an outlier that seems to have spiked again very recently).

It is important to note that several recent sales listed on Card Ladder in the past quarter are unverifiable eBay sales with few data points. While recent trends bode well for collectors, theres no guarantee that the market wont see further negative movement in the near term.

1999 1st Edition Holographic Mewtwo PSA 10, Card Ladder

The Outlook

The Bull Case

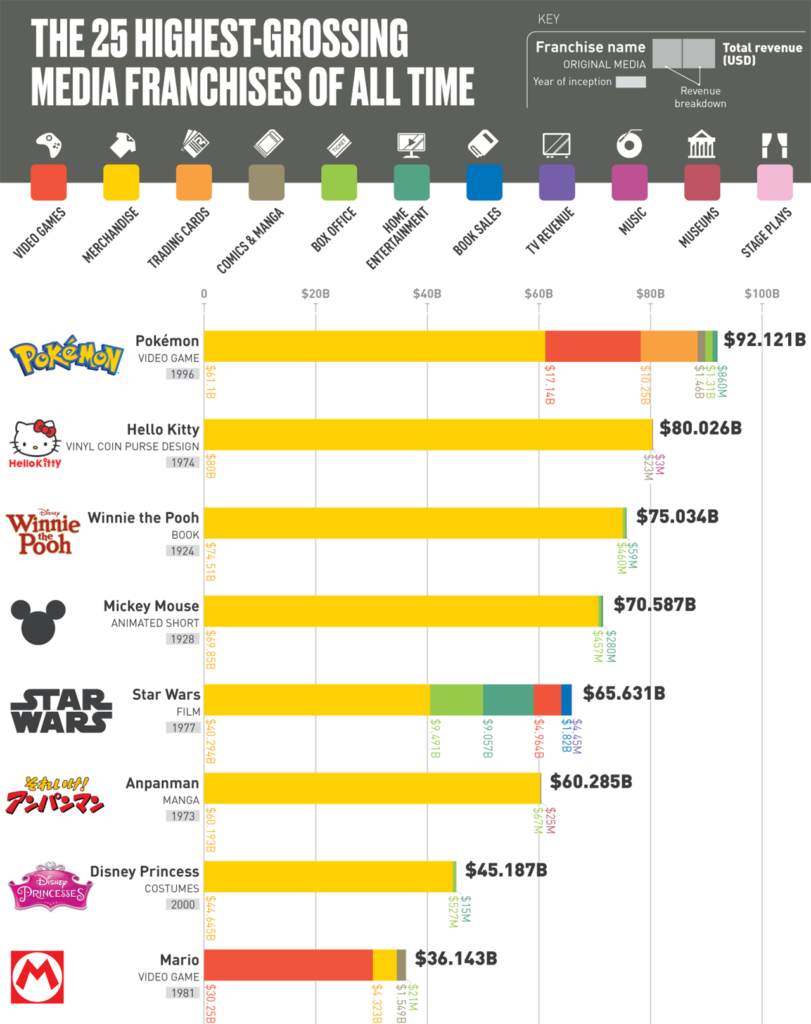

In August 2019, a popular infographic was circulated showing Pokmon to be the highest grossing media franchise in history at ~$92B, surpassing Marvel, Harry Potter, and Star Wars.

The franchise is a sprawling universe of diverse products, from video games to trading cards to television shows. It remains a symbol of 90s-born millennial childhoods, and has continued to stay relevant for over 20 years with several catalysts even before the pandemic boom:

As we know, by 2020, Pokmon reached new heights of popularity with card unboxing videos trending on streaming platforms like YouTube and Twitch. Various influencers and celebrities began to publicize their passion for Pokmon cards. Logan Paul famously began promoting investment in the cards in September 2020, bought a Charizard card for $150,000 from Pawn Stars Gary in October, then wore his Charizard card as a necklace to his fight with Floyd Mayweather in June of this year. Pokmon cards saw some of the biggest gains on eBay in Q1 of 2021 (+1,046%).

All this points to the franchises cultural longevity and the potential for continued future catalysts and demand for Pokmon products.

Even if no additional catalysts were to emerge, as the generation for whom Pokmon holds the most cultural resonance (mostly younger millennials) advances in their careers and comes of age financially, one could easily imagine an increasing amount of capital chasing a limited number of Pokmon grail cards. It may be that the true Pokmon boom ends up being not 2020, but 10-15 years from now when younger millennials (Generation Pokmon) reach their peak earning years.

The Bear Case

Still, it remains to be seen whether the Pokmon brand will continue to stay relevant and top of mind to millennials in the future. The success of Pokmon Go, for example, played a large part in bringing Pokmon back into the current pop culture water cooler, and thus millennials remembrance and revisiting of Pokmon cards. If the Pokmon Company is unable to continue creating relevant products that capture societal attention in the future, demand for cards could conceivably fall.

In addition, it is also unclear whether the cards specifically will continue to serve as a key representative cultural asset of the franchise, even if the brand retains relevance.

Most importantly, the Pokmon card market obviously experienced significant activity and a surge in prices in the past year and it is reasonable to wonder whether such prices are sustainable especially short term. As noted in our commentary on the markets trajectory, there is a very fair possibility that prices could fall significantly and the market could see negative trends again within a few months. Further, as the category gains momentum, more cards may be submitted for grading, increasing the population of this card and grade and detracting from its grail status.

Conclusion

While evaluating investments in collectibles is often an uncertain exercise, with limited data points and evaluations largely dependent on ones views on the future of the market, we are excited to present an asset with such a legacy of cultural significance to our community.

Expand your investment portfolio beyond cards

For many, collecting and trading cards is more than just a hobby. And when you’re ready to explore opportunities beyond the world of cards, Public is here to help. On Public, you can build a multi-asset portfolio of stocks, options, bonds, crypto, ETFsand more. Plus, you can access AI-powered fundamental data and custom analysis to guide your investment decisions.

Sign uptoday and explore how you can expand your investment portfolio beyond card collecting. With options like high-yield cash accounts (HYCA) and expert guidance on stocks, crypto, and ETFs, Public is your platform for smarter investing.