The right coin is worth serious change.

In January, a Las Vegas collector sold what’s believed to be the first silver dollar ever printed by the U.S. Mint for $12 million. It’s the latest high-profile sale in a red hot coin collecting market. Last June, a Double Eagle gold coin from 1933 (when it had a face value of $20) sold for a record $18.9 million in an auction at Sotheby’s.

If you’re wondering whether the coins in your pocket are worth more than loose change, you’re not alone. Let’s take a look at the history of the hobby and why coin collecting is popular again. We’ll also share a few tips if you’re thinking about starting a collection.

A Brief History of Coin Collecting

Coin collecting might be one of the world’s first hobbies, in part because coins date back a lot further than paper money, perhaps as far back as 2,600 years ago in China. Humans have been admiring the artistry and valuing the bullion in coins for millennia. Case in point, the emperor Caesar Augustus (the heir of the Caesar you’re thinking of) was reportedly fond of giving old and rare coins as gifts. And he ruled Rome from 27 BC until 14 AD.

In the third century AD, the Roman Empire unintentionally created a prototype for a collector’s market with a commemorative set honoring past emperors. Rulers throughout Europe and Asia would seek to be immortalized on coins over the next few centuries, reflecting the style and design of those Roman coins.

The size, portability, and detailed imagery of coins meant they became small tokens of art passed down by generations. The “hobby of kings,” as coin collecting became known because it was seen as something reserved for the wealthy, was fueled by the popes, poets, and patrons of the Renaissance in the 15th and 16th centuries.

As coins rose in value, the number of forgeries rose in tandem. Numismatics, the study of coins, became a serious pursuit in response. In the 18th century, numismatics was considered an academic science, right around the same time that a fledgling new government began issuing its first currency.

Coins were seen then as investments because of the metal (often gold or silver) they contained. Trade associations and coin shows arrived in the past century helping to connect numismatists (collectors) and further develop a global trade of coins.

Coin collecting may have peaked in the 1960’s – the first international coin convention was held in Detroit in 1962. (And, yes, there is a commemorative coin set to honor the four-day event organized by the American Numismatic Association and the Canadian Numismatic Association.) But most collectors today will talk about the heady days of the 1980’s.

Source: coincommunity.com

Soaring gold and silver prices and rising inflation supercharged the coin collecting market four decades ago. In the late 1970s, a pair of brothers, Nelson Bunker Hunt and W. Herbert Hunt attempted to corner the silver market, driving the price of silver from $6 to $50 an ounce. The price of bullion coins rose with the price of silver.

The rising prices attracted the attention of Wall Street with limited partnerships formed to solely invest in rare coins and the arrival of professional coin grading services. If this all feels like a treasure hunt, imagine the world in 1988, when the SS Central America, a steamship with more than 15 tons of gold that sunk in 1857, was discovered off the coast of South Carolina.

The U.S. Mint also helped power the collecting craze. They stopped producing Susan B. Anthony B. Dollars in 1981 after only three years and issued a series of commemorative coins to raise money for the U.S. Olympic team, as well as repairs to the Statue of Liberty. It was the first time the mint had issued commemorative coins since 1954. And in 1986, the U.S. Mint released silver and gold American Eagle coins, an homage to the double eagle coins of the early 20th century that proved popular with precious metal investors.

Source: U.S. Mint

The pursuit of rare coins has come in and out of vogue since the boom market in the 1980’s driven by concerns over inflation (sound familiar?) and the wildly popular release of the U.S. Mint’s 50 State Quarters that ran from 1999 to 2008.

Why Are Coins a Hot Investment Commodity?

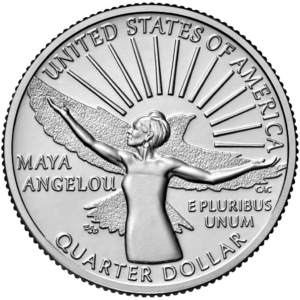

If you’re thinking that coin collecting is a dusty, staid hobby relegated to community halls and glass cases in antique stores, you’re missing the resurgence of the classic pursuit. The newly released Maya Angelou quarter is getting serious love online and record prices continue to be set at auction.

Source: U.S. Mint

A coin depicting the assasination of Julius Caesar, minted in 44 BC, recently sold for $3.5 million. And in 2021, there were 22 individual coins that sold for more than $1 million at auction with another estimated dozen private sales that topped the seven-figure mark.

Coins are increasingly being seen as a tangible hedge against inflation as well as a real-life asset where crypto gains can be parked.

“There’s also a lot of new money from cryptocurrency where people are just randomly making millions of dollars and they don’t know what to do with it, so they’re trying to buy solid stuff,” collector Rex Goldbaum said in an interview with The New York Times.

Likewise, the attention given to digital currency has also spilled into physical coins, a market that may feel more approachable to some investors. Collected coins are an asset that are easy to liquidate. And don’t underestimate the value that people place on a piece they can touch that’s connected to prior generations.

“I like something that you hold in your hand that other people have held in the past…I like the history,” said Goldbaum.

The methods for trading coins have also become accessible to more people. Coins aren’t just sold at in-person conventions or hobby shops. Online auctions are global affairs and the Instagram set is now searching for silver dollars alongside a new fit as physical coins are being traded via social media.

View this post on Instagram

How To Get Involved in Coin Collecting

The resurgence in coin collecting is being driven by new collectors, an increased interest in rare date gold coins, and a return of classic 1980s trends like “brilliant uncirculated” sets, collections of coins that look shiny and new because they weren’t inside cash registers or people’s pockets.

Rarity and oversized demand are still the key drivers of price at the top end of the coin collecting market. Coins that regularly fetch seven figures often have a unique combination of circumstances surrounding their minting. They might be a novelty coin (they only minted six) like the $1 million Canadian Gold Maple Leaf that weighs more than 200 pounds. Or a rare Lincoln penny (there are believed to be less than 40 in in existence) made from copper in 1943 (the war effort’s need for metal meant that nearly all of the pennies from that year were steel).

It’s unlikely – but not impossible – that the coins in your change jar are worth something. But if you’re willing to look, you’ll want to keep an eye out for rare errors, very specific misprints at the time a coin was minted. That’s how a 50-year-old penny is now worth $24,000.

Coins, like cards or unboxed video games, are graded based on their appearance (here, you’re looking if a coin has luster or is damaged). Collectors also consider whether a coin was in circulation or issued as a commemorative piece. Third-party coin grading services like the Professional Coin Grading Service and Numismatic Guaranty Corporation even certify coins. That certification, not unlike the authentication services in the Beanie Babies market, can provide a baseline of certainty for investment.

An effective way to determine if a coin is worth purchasing – similar to a vintage video game or trading cards – is to consider the grade of a coin alongside its expected worth in a pricing guide or sales price in recent auction results. You can then figure out if you’re getting a bargain or buying above the current market.